Bank Account Germany Overview

Check out our comparison of the best German bank accounts

Check your Schufa credit record free of charge

Recently one of my readers asked me if it would make sense to apply for a DKB account as he *thinks* he has a bad Schufa score and they would not accept him as a customer. Well… *thinking* and *knowing* are two different things… Therefore I’m going to show you in this blog post how to check your Schufa score in Germany free of charge.

What is Schufa and the Schufa score?

Schufa is a German private credit bureau with the objective to protect its clients such as banks or telecommunications companies from credit risks. They currently have records on more than 60 million people living in Germany, including foreigners with a German residency. The records contain for example all your bank accounts and mobile contracts and they track all invoices that are unpaid or were paid late (e.g. also bills from online shops). Basically Schufa tries to measure how reliable you’ve met your financial obligations.

So it’s definitely recommended to keep your Schufa credit record clean as the record is checked whenever you want to open a bank account or mobile contract. The following examples are occasions when your Schufa credit score will be checked:

- Opening a bank account

- Applying for a credit card

- Making a mobile contract

- Applying for a loan

- Pay by invoice in an online shop

Sometimes also landlords request a Schufa report from you in order to check how reliably you are paying your bills.

How to check your Schufa score

Once you have registered your address in Germany (Meldebescheinigung) Schufa automatically creates a record and your German bank accounts, mobile contracts etc. go into your record from that moment on.

You are entitled to one free Schufa credit record report per year. Just follow the below steps to get your report:

- Go to the Schufa website and click on “Jetzt beantragen” (Order now) under “Datenkopie (nach Art. 15 DS-GVO)”

- Complete all fields marked with an asterisk (*) and click on “weiter” (Next)

- Click on “Absenden” (Submit)

You will receive your Schufa report a few days later by mail.

How to interpret your score?

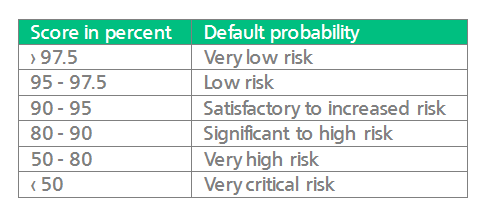

On the report that you have received from Schufa you will see entries for the bank accounts you have opened and credit cards or mobile contracts. You will also see scores for the different categories such as banks, telecommunications companies etc. See below for a summary of the scores and the respective Schufa ratings:

If you think there’s a wrong entry in your Schufa record you can get in touch with Schufa and resolve the problem with them.

How to keep your score healthy?

As mentioned above your Schufa score is very important for your everyday life as it shows companies if you can be trusted as a customer. Here are some tips how you can keep your Schufa score on a high level:

- Pay your bills in time

- Don’t overdraw your bank account too often

- Don’t open too many bank accounts or credit cards

- Do not change your bank account too often

I hope this article sheds some light into the myths around Schufa! 🙂 Should you need any further help or have questions, feel free to leave a comment or simply send me a message.

If you want to see an example of a Schufa report, check out this article.

48 Comments. Leave new

How can we find out about fines for without ticket travel in a train or the radio tax overdue? Will it also be considered in Schufa for the credit score? How can we find out about any of those kinds of overdues?

Dear Siddharta,

if you do not pay these fines in time, chances are high that this information will be added to your Schufa records and it will negatively impact your Schufa score.

You can get a free Schufa credit record as described in this article to check if there are any negative entries.

Hope this helps!

Best Regards,

Dominik

Very useful artcile. My question is, I came to live to Germany in January, and then discovered that I could not buy things in rates or even make a car leasing because I did not have a schufa score. After a while I opened a german bank account. The thing is, when am I gonna be able to make a car lease for example? How long does the schufa take to affect Positivly my score?

Dear Joaquin,

It typically takes some time to build a positive Schufa score in Germany. Having a German bank account and handling it responsibly, along with paying bills on time (e.g. your credit card bills), can help improve your score. The time it takes can vary, but it might take several months to a year or more to establish a good credit history for things like car leases. It’s advisable to check your Schufa score regularly to see how it’s improving over time.

Best Regards,

Dominik

It’s interesting that you advise on not openning too much credit cards. Too much credit cards mean too much limit and too less utilization rate, which is a good indicator for credit metrics. Seperately, do you know if Shufa score is affected by unpaid invoices of online services like immoscout24? How can we know what caused the reduction in our score?

Hello,

there are various factors taken into account for the calculation of the Schufa score. Unfortunately this is not really transparent and the exact metrics are not published by Schufa.

However unpaid/long overdue invoices are definitely influencing the score negatively. If you request the free copy of your Schufa score, you will see which providers have influenced your score.

Best Regards,

Dominik

Hi,

I ordered schufa from immomobilienscout24 & meinshufa.de. From immo.24 I got the report online, but it is not showing any score and it is just showing whether it is positive or negative. And meinschufa.de send the report by post only. So where do I get schufa report with score and online immediately?

Thanks

Ramakanth

Dear Ramakanth,

if you order the free copy of your Schufa report as described in this article, you will get your Schufa report sent by mail and you can find your overall score at the very end of the letter.

If you want to check your score instantly, you can order a so-called “SCHUFA-BonitätsAuskunft” for 29.95 EUR on the Schufa website.

Best Regards,

Dominik

is it possible to get this schufa report in English?

Hello!

no, the report is only available in German.

Best Regards,

Dominik

How can i check my existing schufa online. I have the code

Dear Mahesh,

you can request a free copy of your Schufa report via the following link: https://www.meineschufa.de/de/datenkopie

Best Regards,

Dominik

Hey😁

I would like to know if use Klarna app/Kart/ Onlinekart has an negative effect on my Schufa Score.

Thank you!

Dear Livia,

there are various factors that influence your Schufa score. Using for example Klarna can have both a positive and negative effect on your Schufa score. If you pay your Klarn bills in-full and in-time this will positively influence your score. However if you fail to pay in time this will have a negative effect.

All in all the calculation of the Schufa score is unfortunately not very transparent…

Best Regards,

Dominik

Hi,

Went to bank to open a account but the lady said to me that my name is on schufa that they can’t open an account for me.

Please what should I do to clear this issue so I can get a new bank account because i have credit card balance that are to be settled?

Dear Yong,

my recommendation would be to get a free copy of your Schufa report as described in this article. Then you’ll be able to identify which entries you have and you can contact the respective institutions (banks, mobile providers etc.) to resolve the issue.

Best Regards,

Dominik

I have been in Germany for close to 1.5 years and started with one bank account at Schufa of 97. I tried getting a credit card and did not realize it was denied and tried another bank (again denied).

Now on my free Schufa i see the rating go down with every credit card company credit check request. And i am ending up with worse score even after paying all bills, rents on time and having a stable financial history.

Is it common for score to go down with every check? And what can I do about it now?

Dear Nidhi,

unfortunately the scoring process of Schufa is not very transparent… Schufa takes various factors into consideration for calculating the score. But in general you can say that the score goes down with every denied credit request. There are two types of Schufa checks when you apply for a credit

1. The so-called “Anfrage Kreditkonditionen” (request credit conditions) is done when you ask for credit conditions. This kind of request is Schufa-neutral

2. The so-called “Anfrage Kredit” (credit request) is done when you have checked the conditions and you’re applying for a credit. This one has an impact on your Schufa score (e.g. a negative impact if a credit request if declined by the bank).

Therefore it’s best to check with the bank which kind of Schufa check they perform before applying for a credit.

Furthermore you can get in touch with Schufa and check with them how your score is influenced.

Best Regards,

Dominik

[…] As with all credit cards in Germany with a credit limit, the amount of the credit limit depends on the wishes of the applicant and on the bank. The bank determines the credit limit for a customer primarily according to the customer’s creditworthiness. The creditworthiness of an applicant is usually checked by the bank via a Schufa query. […]

Hi Dominik,

My partner and I have just moved in Germany from UK. We would like to build a good SCHUFA quickly so that we get the best mortgage rate possible within 1 year or so and buy our home property. In UK, it is recommended to have a credit card and use it frequently even if you will pay in full every month. This allows to be build a good credit score rapidly. Would you recommend such practice in Germany?

Best regards,

Sam

Dear Sam,

that’s definitely a good idea. However the problem is that Schufa doesn’t disclose the details about their credit score calculation and there are many factors affecting your credit score, such as your financial history but also factors like the neighborhood you are living in. However it’s always beneficial for your credit score, if you pay your bills on time (be it for online shopping or your credit card bill).

Best Regards,

Dominik

Hi , i helped one of my friend to take his rented home by showing my Shufa . so i just signed in a page . So i am worried he might used in another places . So how i can check it any idea will be appreciative .

Really informative blog .

Dear Salman,

the Schufa report is tied to your name. So everything that has been registered against your name will be shown in the report (e.g. bank accounts, online shopping, etc.).

You can check the content simply by requesting a free report as described on this website.

Best Regards,

Dominik

Hi, I got a schufa from immobilienscout24.de but only ‘positive’ is written on my schufa document. I have heard that thre must be some ‘score’ on the document. Have I done something wrong? Do you have any idea?

Dear Rabia,

I assume you have requested a so-called Schufa “BonitätsCheck” from ImmoScout24. This is a short version of a Schufa report especially made for renters to show to the landlord. So usually this should be enough to get an apartment.

If you want a more detailed report you can simply request one for free as described on this page.

Best Regards,

Dominik

Hello, I’m in the American military and I am trying to get this form because I want to move into an apartment with my girlfriend. However I have never lived in Germany besides the military base. Will this form even show anything in regards to my history?

Dear TJ,

you can request a copy from Schufa but most likely there won’t be any entries in the report (if they will create a report at all…) as you were never registered in Germany.

Best Regards,

Dominik

Hello.

I just wondering if is possible to get Credit check when i living outside Germany?. My bank in Ireland is asking me about credit check from Germany because i have N26 account in Germany. That’s a bit strange for me because i never even been in Germany.

Regards,

Dear Piotr,

If you haven’t lived in Germany before, you won’t get a credit score report from Schufa as they do not have any data about you.

I would therefore recommend to check with your Irish bank, why they need this from you.

Best Regards,

Dominik

Hi,I lived in Germany 10 years ago and am currently paying back 2 student loans.i do not have a registered address in Germany but need to get a credit report for a bank in Ireland.will Schufa still be able to help without a German address?

Dear Rory,

yes that should be possible. You can enter your address abroad and also specify a former address in Germany on the Schufa request form. Like this Schufa should be able to generate a report for you. Just give it a try with the above described process.

Best Regards,

Dominik

Hi how do you get a Schufa if you are new to Germany do not have an apartment yet and yet you need one to get an apartment and bank account.

It seems like catch 22.

Is there a UK version which would be available which could provide assurances to prospective landlords?

Any advice gratefully accepted!! : )

Dear Thomas,

that’s actually a good question… Have you tried to request a report from Schufa already? They should at least be able to confirm that you do not have any negative entries in Germany and that’s usually what landlords want to know.

What have you done in the meantime?

Regards,

Dominik

Dear Dominik ,

Holding how many banks accounts would then affect the Schufa negatively?

Thanks

Regards,

Dear Romero,

unfortunately I do not have an answer to this question, as Schufa takes various factors into consideration for calculating your score.

Get your report and check the entries. This should give you a good overview.

Best Regards,

Dominik

Hi’

I checked my Schufa score by applying through website. I did received the starter pack . Which helped to register in Schuf. When I checked my credit score it show as 9.91 very risk. For a matter of fact I just have one phone contract and paid them on time. Still why I have that low score . I took the contract on last nov

Can you pls suggest me on this

Dear Ivan,

usually your score is quite low when you start your “financial career” in Germany. And when you pay your bills on time the score should go up quite quickly.

Unfortunately I can also not tell you why your score is that low. Schufa considers various factors for the calculation of your score. If you have further questions, I suggest to get in touch with them directly.

Best Regards,

Dominik

Hello, I am in the process of applying for a mortgage. Does asking rates to multiple banks impact my Schufa score? Thanks

Dear Kay,

There are two different kinds of requests from banks to Schufa for mortgages:

1. The so-called “Anfrage Kreditkonditionen” (request credit conditions) is done when you ask for credit conditions. This kind of request is Schufa-neutral

2. The so-called “Anfrage Kredit” (credit request) is done when you have checked the conditions and you’re applying for a credit. This one has an impact on your Schufa score (e.g. a negative impact if a credit request if declined by the bank).

Hope this helps!

Best Regards,

Dominik

I recently lived in germany 2010.

But I want to return this year.

Can I get a shufa report ??

Dear Christopher,

give it a try… There still might be data stored in your Schufa records. Just follow the above steps to get your free Schufa report copy.

Regards,

Dominik

HI.

i went to open an account in a German bank.the lady said that my name is in schufa , my schufa is already cleared but its will take 3 years to remove my name from schufa list.what is this ?please someone help me.

Dear Saleemi,

did the lady from the bank tell you what kind of Schufa entry you have? A Schufa entry is per se not negative… It’s just a summary of your financial history in Germany (good and bad things).

I would therefore recommend to get a free copy of your Schufa report as described in this article. You will then see what kind information is stored for you.

Best Regards,

Dominik

Hi, thank you for this info. I am moving to berlin in september. Now I wonder if I can already get a SCHUFA check while I am still working in my current country of residence (sweden) or do I need to have my salary slips from Germany in order to get a SCHUFA?

Dear Inge,

this will most likely not work as you do not have a financial history in Germany yet. So even if you would order a Schufa report, there would be no information in the report…

Best Regards,

Dominik

Do I have report in schufa ?

Dear Samira,

just follow the above steps to get a free copy of your Schufa report.

Regards,

Dominik

[…] an earlier post I had already described how you can request your score report from Schufa. Let’s now have a […]